June 24, 2022

Rep. Danielle Gregoire

Sen. Nick Collins

Joint Committee on Bonding, Capital Expenditures and State Assets

State House Boston, MA 02133

via email

Testimony on: House Bill 4864, An Act investing in future opportunities for resiliency, workforce, and revitalized downtowns.

Chairs Collins and Gregoire, and members of the committee:

On behalf of MassINC’s Gateway Cities Innovation Institute, I ask you to report out favorably House Bill 4864 and would like to highlight three items that will be particularly impactful for our small cities. We urge you and your colleagues to endorse them as well.

1. Housing Development Incentive Program (HDIP)—Sections 89-92

MassINC is deeply appreciative of the work that the Economic Development committee did on the Housing Development Incentive Program (HDIP). This includes a one-time cap increase this year to $57 million in order to eliminate the program’s crippling 6 year waitlist, followed by a permanent cap increase from $10 million to $30 million starting in FY24.

HDIP is unique. It is the only housing program in the state that helps make private housing investment viable in weaker real estate markets. Even today, traditional bank financing doesn’t pencil out for housing projects in many Gateway Cities, and that means we’re producing housing very unevenly across the state. We have overheated markets in Boston, Cambridge, Somerville, and similar communities while many of our state’s former mill cities want more housing and have projects ready to go, but cannot get them financed. We’re talking about 2300 new homes ready to go NOW that would leverage over $700 million in investment in small city downtowns and transit-oriented areas.

If you can only build subsidized housing in already poor cities, that exacerbates regional economic and racial segregation. Mixed-income communities support economic mobility and quality of life for all.

HDIP works through a local and state partnership. The municipality starts the process by providing temporary local property tax relief to desired projects, and then the state provides a modest tax credit that helps the project access traditional financing. At an average subsidy of only $25k per unit—compared to $125k or much more for a traditional subsidized unit, we estimate that increasing the cap to $30 million on an ongoing basis could enable HDIP to produce up to 1,200 new homes across the state annually and create $3.75 billion of investment in Gateway City downtowns over 10 years. Without it, and especially in light of inflationary pressures, investments in Gateway Cities threaten to come to a standstill.

2. Small Business District Fund—Section 9, 29-30

The Commonwealth needs a long-term strategy to address the issues that have been plaguing Main Streets for years and eroding their competitiveness. Most significantly, the rise of online retail poses an existential threat to many local and independent businesses. The ones who survive and thrive usually benefit from ample foot traffic, which means thriving, walkable, and attractive areas.

These areas require careful management beyond the capacity of local government to provide. Instead, it requires public, private and nonprofit partnerships working together to do the job, such as branding, programming, landscaping, and supportive services.

Fortunately, we have such district management tools in Massachusetts, yet only a small number of communities currently benefit from them. For example, Business Improvement Districts require adopting a property fee, and many low-income cities with modest property values and vulnerable businesses are reluctant to do so. On the other hand, many communities have adopted cultural districts, but they are volunteer-driven and have no funding source. Parking Benefit Districts are new and need statutory tweaks to become widespread.

House Bill 4864 would create a Small Business District Fund supported by a dedicated revenue stream of 5% of the state’s online retail tax revenue. We estimate that this would generate several million dollars per year, which together with the local match that would be required, is enough to support a robust pipeline of small business districts in vulnerable communities. This could include establishing or strengthening Business Improvement Districts (BIDs), cultural districts, parking benefit districts, or other types of local partnerships. Designating this ongoing revenue source would be both an appropriate way to reinvest a portion of those tax revenues in our communities as well as ensure that the program is responsibly sustained in the future.

3. Inclusive entrepreneurship and state procurement reform—Sections 4-6

How we deploy the state’s remaining ARPA dollars is just as important as when those funds get spent.

Recovery funds represent a once-in-a-lifetime opportunity to close large racial and ethnic disparities in business ownership because these infrastructure investments will establish the supply chain of the future for electric vehicles, offshore wind, and other advanced industries.

People of color are far more underrepresented in public infrastructure spending than they are in business ownership overall in Massachusetts. We must recognize that this is largely the byproduct of the state’s outdated procurement laws, and therefore a major public policy failure.

MassINC has been working with BECMA, the MMA, and others to propose changes to state procurement law that would provide municipalities with the tools they need to make public infrastructure investment more equitable. With billions of dollars from ARPA and the federal bipartisan infrastructure bill on the move, time is of the essence. As you work to see that these funds get spent in as transformational a manner as possible for our commonwealth, this committee can provide valuable leadership on this important issue.

The Economic Development committee inserted important language in House 4864 that promotes diversity and inclusion in entrepreneurship. We hope that your committee will retain this language and potentially take further action by reforming state procurement law so that recovery and infrastructure contracts might benefit more businesses led by people of color, who have been terribly underrepresented in state contracts. Please refer to BECMA and MMA suggested language on procurement reform.

Thank you for your attention.

André Leroux

Director, Gateway Hubs Project

Additional Testimony Submitted by Shaw Rosen, Lupoli Companies:

I am here today to speak in support of increasing the annual cap on the state’s highly effective Housing Development Incentive Program (HDIP).

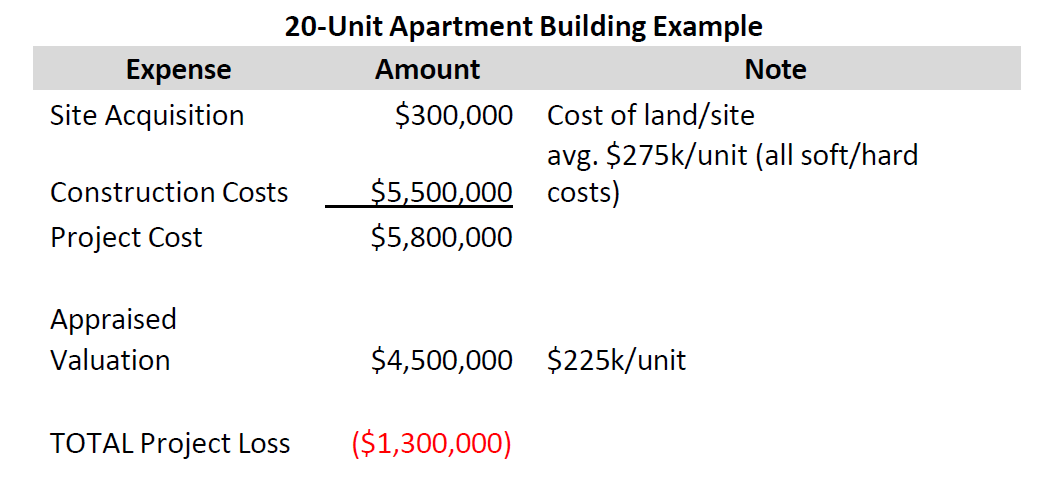

As a Gateway Cities developer, Lupoli has found HDIP to be a critical program. Why is it needed by private developers? Because the cost of building market rate housing is practically the same in Gateway Cities as it is in Boston, but because rents are so much lower in these small cities, the projects are hard to finance without the HDIP subsidy.

The high demand for the program has been hampered by the $10 million annual funding limit, pushing the practical availability of funding out 5 to 6 years. You just can’t hold a deal together for that long. Now, rising construction costs and interest rates are making it worse. As a result, many otherwise viable projects are falling apart or stalled, threatening the progress being made to create more market rate housing in the cities that need it most.

We have spoken to many other Gateway developers and this is what they tell us about why HDIP works:

• It allows each city to create policies according to their needs, which helps developers solve unique financing and site challenges. Some cities need 100% market-rate units. In others, it can be used to create mixed-income developments with both affordable and market-rate units.

• HDIP leads to lower transaction costs. It can support moderate sized projects of 20 to 80 units. It is available for either new construction or rehabilitation. These infill and adaptive reuse projects are complicated and difficult to put together, especially for smaller developers, who are often local and want to invest in their own communities. HDIP is key to making traditional bank financing feasible for these challenging but desirable projects.

• Since its inception, many properties that had been vacant for decades are now providing housing that is needed. They lease up quickly, which speaks to demand.

Gateway cities offer amenities that today’s hybrid workforce wants, such as walkability, a diverse population, unique small businesses, arts and culture, and transportation.

The state also has a cadre of creative and experienced developers who know the cities and how to build housing there.

HDIP can unlock this potential.

Shaw Rosen

Development Consultant

Additional Testimony Submitted by Jonathan Cozzens, Lee Properties:

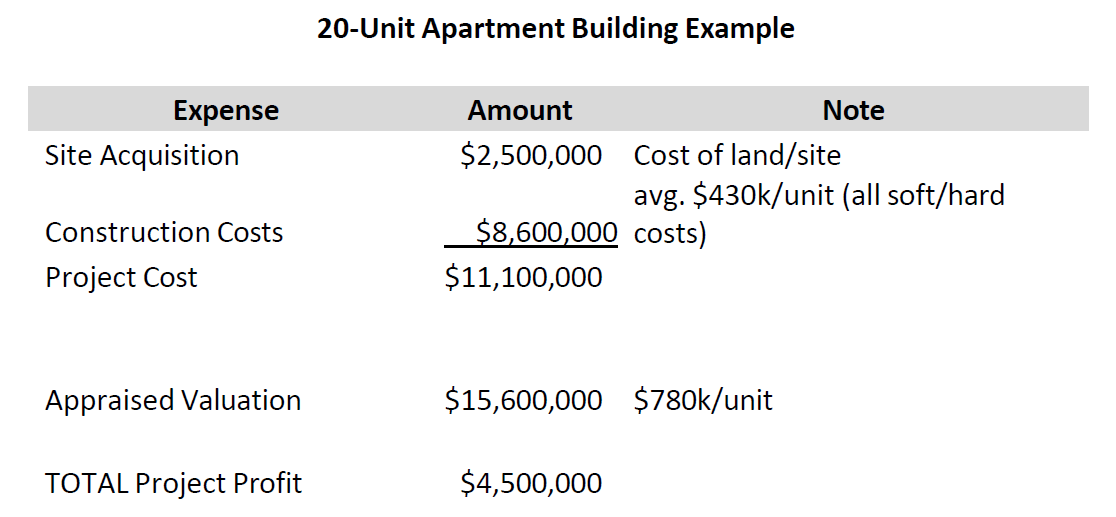

Financing illustration Boston vs Gateway City: